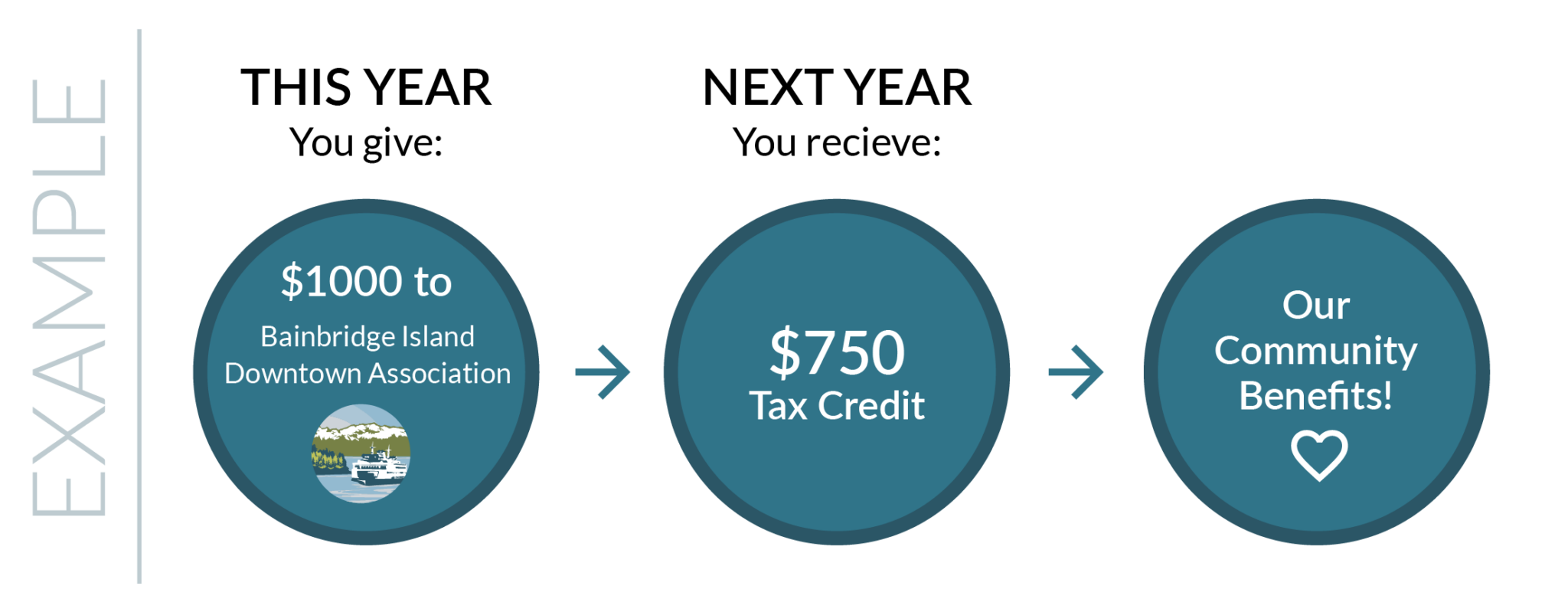

Support your community today. Earn a tax credit tomorrow.

The Washington State Main Street B&O Tax Credit Incentive Program allows businesses to make a donation to the Bainbridge Island Downtown Association and in return, earn a 75% state B&O tax credit on that amount. In addition, the donation is eligible for a federal tax deduction. A powerful way to support your downtown!

- Monthly Art Walk

- 3rd of July Street Dance

- Tree lighting ceremony

- Flower baskets

- Holiday decorations

- Over the street banners

- Halloween street celebration

- Seasonal pole banners

- Historic preservation

How to Enroll

Step 1 – Visit the Department of Revenue Website

Visit the WA Department of Revenue website and follow these step by step instructions to make a pledge:

- Starting the second Monday of January each year (pledge early, as there is a cap – see additional information below), go to: secure.dor.wa.gov

- Log in

- Click on “Get Started” link

- Click on your “Excise Tax” account

- Click “Credits” in the toolbar

- Click on “Add Main Street Application”

- Find Bainbridge Island’s Downtown Association and enter the Contribution Amount; click next

- Fill out Authorization Information and click Submit.

Step 2 – Make a Donation!

Before November 1, make a donation to BIDA. You can make the donation online or mail a check to the following address:

BIDA, 600 Winslow Way East, Suite #239, Bainbridge Island, WA 98110

Step 3 – Check your Account

In January, when you go to pay your B&O online, you will have the credit available in your account. It’s really that simple!

Thank you so much for supporting Bainbridge Island’s Downtown Association!

Additional Information

- Donate to the BIDA and receive a state B&O tax credit of 75% of the donation amount.

- Receive a federal tax deduction for the remaining 25%.

- This is a way to direct your tax dollars right back into your community.

- Pledging for the program starts the second Monday in January.

- Pledge by March 15th, pledging early is best!

- Each Main Street city has a cap of $170,940 in donation pledges in Q1.

- Pledge early but your donation to BIDA can be made as late as November 1.

- Pledges are made on the Department of Revenue website.

- The federal tax deduction can be taken in the same year as the donation and the state B&O credit becomes

available starting January of the following year. - Any donation amount works.

- Credits may not be carried over to subsequent years.

- Anyone who pays B&O taxes in Washington can contribute to any Main Street Program in Washington (you don’t have to be on Bainbridge Island).

- This program is unique to Washington and has been a proven economic catalyst for historic Main Street towns since 2006.

*Please note: Interested contributors can confirm the full extent of these tax benefits with their accountant. Want to learn more? Contact kelle@bainbridgedowntown.org or call (206) 842-2982.

The Main Street Tax Credit Incentive Program is established in RCW 82.73. For more information about the program, please view the Main Street Tax Credit brochure in English and Spanish and the Step-by-Step Guide to Applying from the Department of Revenue.